5 Best Credit Card Plans in Singapore for All Needs (2021)

Do you prefer credit card when paying instead of cash? If so, you should get your hands on the best credit cards in Singapore for much faster and easier cashless transactions!

Since there are countless banks in Singapore offering credit cards with different perks and benefits, it can be a bit hard to know which credit card matches your lifestyle. To help you in choosing the right credit card, we’ve provided a list of the top credit cards in Singapore.

Along with the list, we also saved you a few clicks by compiling the requirements, perks, and related charges and fees for each card. We’ve also done the nitty gritty of credit card comparison in Singapore for you.

Stick around until the end to check out our credit card suggestions list for different types of spenders. But first, let’s talk a bit more about credit cards

What Is a Credit Card?

A credit card is a type of payment card issued by a bank that allows the cardholder to borrow money to buy goods and services.

The cardholder then promises to pay back the amount of money borrowed from the bank on the bill’s due date, plus other applicable charges.

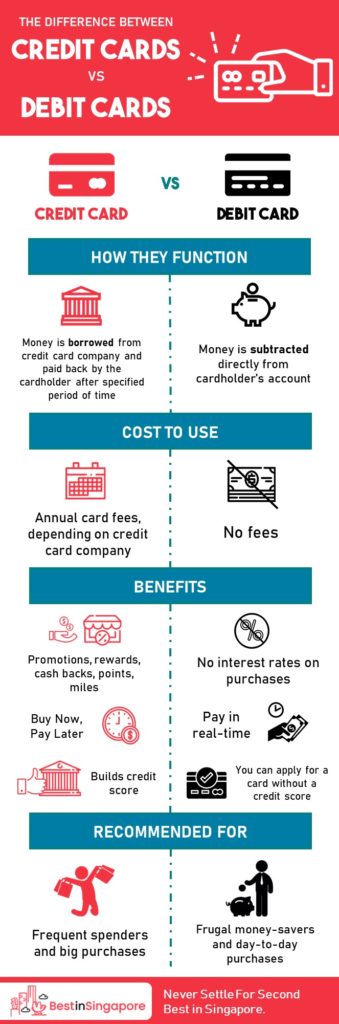

Difference Between Credit Cards and Debit Cards

A credit card allows the cardholder to borrow money (up to a certain limit) from the bank.

On the other hand, a debit card only allows the cardholder to withdraw money from his bank account.

So, it’s only possible to use a debit card if there’s actually money in the cardholder’s bank account. Theoretically, you don’t need money in your bank account to use a credit card, in contrast.

Either way, both provide the convenience of cashless transactions and eliminates the need to go to the bank to withdraw money. Check out the infographic below to know more about the differences between a credit card and a debit card.

Now that we’ve gone through all the technical details about credit cards, here are some reasons why you should get a credit card and why it should be one from our list of the best credit cards in Singapore.

Benefits of Having a Credit Card

1. Pay Over Time

If you’re planning to make a big purchase, a credit card may be your best option. By using a credit card, you can divide that big purchase into smaller payments over a certain period of time.

Besides the convenience of paying over time, the best credit cards in Singapore even offer cashbacks and low to no interest rates on different purchases.

2. Rewards and Promotions

Most credit cards in Singapore offer rewards and promotions in the form of discounts, freebies, travel miles, and more. Some even offer sign-up bonuses upon application.

This is where the to credit cards in Singapore truly shine, as they tend to offer more and better rewards than others.

3. Emergency Funds

If you find yourself in a situation where you’re short on cash and need to make an emergency purchase, a credit card can come in handy. Some of the best credit cards in Singapore even come with certain types of insurance for emergency situations like loss of income.

4. Building Your Credit Score

If you use your credit card often and always pay on or before the bill’s due date, there’s a good chance that your credit score will be good or improve and you will have a good standing with credit card issuers in Singapore.

Having a good credit score tells financial institutions that you are reliable and trustworthy with the money you borrow from them.

The best credit cards in Singapore also offer incentives for those with good credit scores such as the increase of your credit card’s spending limit, easier loan applications, and more.

The Best Credit Cards in Singapore Overall

Out of all the credit cards being offered to Singaporean consumers, we’ve compared credit cards in Singapore and painstakingly chosen the top 5 best credit cards just for you. Check them out!

1. AMEX True Cashback Card

| BEST FOR | Cashback and Complimentary Passes |

| PAYMENT NETWORK | American Express |

| ANNUAL FEE | S$171.20 (inclusive of GST); waived for the first year The first 2 Supplementary Card fees are waived; S$85.60 (inclusive of GST) for each subsequent Supplementary Card |

| ELIGIBILITY | For residents: at least 21 years old with an annual income of S$30,000 or higher For foreigners: at least 21 years old with an annual income of S$60,000 or higher Supplementary cardholders must be at least 18 years old. |

| WEBSITE | https://www.americanexpress.com/sg/credit-cards/true-cashback-card/ |

If you want a credit card that has many perks and benefits, then you will definitely love the AMEX True Cashback Card. It comes with a complimentary stay at Village Hotel Sentora in a deluxe room worth more than S$360.

But we chose this as one of the best credit cards in Singapore for more than that. Among other things, it also comes with a welcome bonus in the form of a 3% cashback on a minimum purchase of S$5,000 in the first 6 months.

What’s more, after your welcome bonus, you will be entitled to an unlimited cashback of 1.5% on all eligible purchases.

It’s also one of the best credit cards in Singapore for frequent travellers because it provides travel inconvenience and travel accident insurance. For its annual fee, you only have to pay S$171.20, which is automatically waived for the first year.

Pros

- No minimum spend and cap on cashback

- Immediate cashback in the same month’s statement

- Additional 1% cashback on foreign currency purchases

- Additional 1% cashback on selected essential bills

Cons

- Low standard cashback rate

- Not as widely accepted as VISA or MasterCard

Charges and Fees

| Interest on purchases (where applicable) | 26.90% per annum compounded if payment of the balance is not paid in full 29.99% per annum if the account has three or more defaults that have been unpaid for two or more consecutive months in the last 12 months |

| Interest-free period | 22 days |

| Interest on cash advances | 26.90% per annum compounded daily from the date of withdrawal amount to the date when the relevant fees are paid in full |

| Minimum monthly payment | 3% or S$50, whichever is higher |

| Late payment charges | S$90 if the minimum monthly payment is not paid by the due date |

| Cash advance fees | Handling fee of 5% per withdrawal |

| Fees for foreign currency transactions | 2.5% |

| Lost/stolen card liability | S$100 |

| Retrieval Fee for Documents | S$10 for Statement of Account; S$5 for record of charge |

| Service Charge for Returned Cheques/GIRO | S$50 |

Customer Reviews

The AMEX True Cashback Card is arguably one of the best Singapore credit cards, earning many praises from its loyal customers. It’s definitely one of the top 10 credit cards in Singapore.

Take a look at what Noelle has to say:

“I had recently applied for Amex True Cashback card and I would highly recommend people to apply if they are intending to make big ticket purchases. First timers for credit cards in sg are able to get complimentary vouchers if you fulfil the initial spend within a stipulated time. It is really a TRUE cashback card. Oh, did i mentioned? Their customer service via app livechat was superb and efficient!! Thumbs up.”

According to Dirl, here’s the reason why he considers the Amex True Cashback as one of the best credit cards in Singapore:

“I like this particular cashback card as it has many other offers like SPC cashback, Lazada cashback, SP cashback, AMEX Pay cashback from time to time and the barrier to receive this cashback is relatively low. I first applied thinking using it for first 6mth with 3% cashback but later continue to get good offer from them. Their customer service is also probably one of the best among all the CC in Singapore. The only drawback is probably it is not as widely accepted as compared to VISA & Master. But still this is one of their best CC to me.”

2. Citibank Rewards Card

| BEST FOR | Shopping Rewards and Promotions |

| PAYMENT NETWORK | VISA |

| ANNUAL FEE | S$192.60 (inclusive of GST); first year waived S$96.30 for each supplementary card |

| ELIGIBILITY | For residents: at least 21 years old with an annual income of S$30,000 or more For foreigners: at least 21 years old with an annual income of S$42,000 or more Supplementary cardholders must be at least 18 years old. |

| WEBSITE | https://www.citibank.com.sg/gcb/credit_cards/rewards-credit-card.htm |

The Citibank Rewards Card is known for its wide pool of rewards to cardholders. You can receive up to 30,000 points when you spend at least S$3,000 on the first three months.

Another thing that makes this one of the best credit cards in Singapore is that there’s no minimum spend. You can also earn a rebate of up to 10% on different locations like Starbucks and Sheng Shiong.

You also get rewards every time you make online and retail purchases on Lazada, TANGS, and many more. Basically, every little transaction using this card has a corresponding reward, even when you book a car using Grab.

On top of that, it also rewards frequent travelers. You get to enjoy complimentary travel insurance when you use this card to pay for your airfare. We’re not too surprised that this is one of the best credit cards in Singapore for 2020.

Pros

- No minimum monthly spend

- Wide variety of rewards and promos

- Free travel insurance

Cons

- Rewards and promotions mostly for travel, fashion, and apparel, not for essentials

- Rewards cap of 4,000 miles or 10,000 points per month (S$40 value)

Charges and Fees

| Interest on purchases (where applicable) | 26.90% per annum compounded if payment of the balance is not paid in full 29.99% per annum if the account is past due in the current month |

| Interest-free period | 25 days |

| Interest on cash advances | 26.90% per annum and cash interest rate |

| Minimum monthly payment | 1% of current balance + 1% of any outstanding unbilled installment amounts + interest charges + late payment charge OR S$50, whichever is higher, + overdue amounts |

| Late payment charges | S$100 if the minimum monthly payment is not paid by the due date |

| Cash advance fees | S$15 or 6% of the amount drawn, whichever is higher |

| Fees for foreign currency transactions | 3.25% |

| Overlimit fee | S$40 |

| Retrieval fee for focuments | S$0 – 100 for Statement of Account; S$5 – 10 for record of charge Depends on the age of the statements being retrieved |

| Branch service fee | S$10.70 |

Customer Reviews

Going by many credit card reviews in Singapore, it’s quite evident that the Citi Rewards Card is considered to be one of the best credit cards in Singapore. This is because of the numerous positive reviews it receives from its loyal customer base.

Riyan R. says this:

“Applied for this card as singsaver at that time was offering $200 cash via paynow as a sign up bonus. Even before I got approved for this card, I was shown my credit limit if I were to be approved, which is kinda nice I guess. There is an ongoing sign up bonus of $350 cashback or 30k points with conditions when you apply directly from Citibank. This card earns you 10x points (4 miles per dollar) on shopping and online spend, which is great for those times when you really need to shop! I use this card specifically for that purpose. All other spend earns 1x points (0.4 mpd). These points can either be transferred to miles or cash rebate off your credit card bill. Citibank has a wide range of different airline partners so one doesn’t have to stick to one airline when redeeming for miles! Those who love to travel and shop can reap in the benefits of this card. Since it is not possible to travel in this current COVID-19 situation, why not make use of this time at home to earn miles for when we all can travel again while you shop?”

A customer named Xinyu considers the Citi Rewards Card to be one of the best Singapore credit cards and sums up their Citi Rewards experience in a short-but-sweet review:

“My preferred credit card! There were lots of discounts /rebates relating to Citibank credit card. The customer service officer are approachable, and its easy to have the waiver of the annual fees. Highly recommended!”

3. Standard Chartered Unlimited Cashback Card

| BEST FOR | Unlimited Cashback |

| PAYMENT NETWORK | MasterCard |

| ANNUAL FEE | S$192.60 (including GST); first two years waived No annual fee for supplementary cards. |

| ELIGIBILITY | For residents: at least 21 years old with an annual income of S$30,000 or higher For foreigners: at least 21 years old with an annual income of S$60,000 or higher; must hold a Singapore Employment Pass Supplementary cardholders must be at least 18 years old. |

| WEBSITE | https://www.sc.com/sg/credit-cards/unlimited-cashback-credit-card/ |

Standard Chartered is one of the most trusted banks in Singapore, offering a wide variety of credit cards for all types of customers. Among their credit card line-up, our top pick for the one of the best Singapore credit cards is the Standard Chartered Unlimited Cashback Card.

What makes this credit card great is that every purchase comes with a cashback of at least 1.5%, making sure that you save some money on every transaction made. In addition, annual fees can also be waived for 2 years, unlike most credit cards.

If you need to use your card on something really expensive, you may ask for a temporary credit limit increase. Other credit cards also have this feature but Standard Chartered approves such requests easily.

Pros

- Up to 5 supplementary cards and no annual fees

- Unlimited 1.5% standard cashback with no cap and minimum spend

- Bonus 5% and S$80 cashback upon sign up

- Waived annual fees for 2 years

- Temporary credit limit increase

Cons

- No travel rewards compared to other credit cards

- Low standard cashback rate

Charges and Fees

| Interest on purchases (where applicable) | 26.90% per annum If payment is not made in full on the due date, a finance charge of 0.074% daily from the past due date up until the full payment is received. |

| Interest-free period | Only applicable if you opt for full payments and not partial payments |

| Cash advance fees | 6% per transaction |

| Interest on cash advances | S$15 + finance charges at 0.082% per day from date of transaction until the date of payment |

| Minimum monthly payment | S$50 or 1%, whichever is higher + interest, fees, and charges + any overlimit and past due amount + (if applicable) monthly installments under EasyPay Programme |

| Late payment charges | S$80 if the minimum monthly payment is not paid by the due date |

| Fees for foreign currency transactions | 1% charge imposed by MasterCard + 2.5% of converted SGD amount |

| Overlimit fee | S$40 |

| Lost/Stolen card liability | S$100 |

Customer Reviews

One of the recurring praises this card has received is that it is convenient and hassle-free to use. Here’s why some customers consider the Standard Chartered Unlimited Cashback Card as one of the best credit cards in Singapore you can get:

According to a satisfied customer named Jayden:

“Any amount of cashback! No longer need to hit the minimum amount of spending, good for flexible spenders. You can call in to waive for another 1 year.”

Anna W. has this to say:

“This card would be great for a minimalist like me, who seldom spend, as there’s no minimum spend to hit.

I use this card to pay for electricity and telco bills, which are also eligible for cashback!”

4. HSBC Platinum Card

| BEST FOR | Rebates and Promotions for Essential Goods |

| PAYMENT NETWORK | VISA |

| ANNUAL FEE | S$192.60 (including GST); first two years waived No annual fee for supplementary cards. |

| ELIGIBILITY | For residents: at least 21 years old with an annual income of S$30,000 or higher For foreigners: at least 21 years old with an annual income of S$40,000 or higher A Fixed Deposit Collateral of S$10,000 can be paid if you do not meet the minimum income requirement. Supplementary cardholders must be at least 18 years old. |

| WEBSITE | https://www.hsbc.com.sg/credit-cards/products/visa-platinum/?promo=AFF1200158& |

The HSBC Platinum Card is one of the best credit cards in Singapore for families because it offers rebates and promotions for a lot of dining- and leisure-related transactions. So, if you and your family love to go out during the weekends, having this card will benefit you much more.

On top of this, cardholders can also enjoy exclusive discounts that the entire family can enjoy. One of the best features of this card is that it has rebates for groceries, dining, and even fuel!

As of 2020, when you sign up for this credit card, you can choose to receive free Samsonite luggage, a S$150 cashback, or $S20 worth of Grab rides.

Pros

- Up to 5 supplementary cards and no annual fees

- Rebates on essential goods such as grocery, dining, and fuel

- Sign-up bonuses

- No annual fee for 2 years

Cons

- Minimum spend of S$600 monthly required for rebates

- Rebates capped at S$250 per quarter or S$1,000 per year

Charges and Fees

| Interest on purchases (where applicable) | 25.80% per annum compounded daily from the date of transaction until receipt of full payment However, a minimum fixed amount of S$2.50 will be charged. |

| Interest-free period | 20 days |

| Cash advance fees | 6% of the amount withdrawn or S$15, whichever is greater |

| Interest on cash advances | 28% per annum compounded daily from date of transaction until receipt of full payment However, a minimum fixed amount of S$2.50 will be charged. |

| Minimum monthly payment | Within Limit: 3% of the outstanding balance or S$50, whichever is greater Over Limit: 3% of the credit limit + excess over the credit limitv |

| Late payment charges | S$55 |

| Fees for foreign currency transactions | 2.8% of the transaction amount |

| Overlimit fee | S$40 |

| Service Charges for Insufficient Funds | S$30 for returned cheques; S$30 for unsuccessful standing instruction/GIRO payment |

| Annual mileage membership fee for Asia Miles and KrisFlyer miles |

SGD denominated accounts: S$42.80 USD denominated accounts: S$24 |

| Tax payment facility administrative charges | 0.7% of payment amount + GST |

| Retrieval Fee for Documents | S$0-10.70 per statement for Statement of Account; S$5.35-10.70 for sales draft Depends on the age of the statements being retrieved |

Customer Reviews

Lots of families have enjoyed the benefits and rewards of having the HSBC Platinum Card.

Here’s what Kathlyn L. has to say about the card and why she thinks it’s one of the best Singapore credit cards for families:

“Yes I think this card can be quite useful for everyday spending because it has specific deals targeted at household expenditures such as a 5% cash rebate on family, dining and fuel spending. something unique about this card is that they also have a deal where kids enjoy for free so if you use this card at HSBC partnered places, you will get free meals, movies and many more activities..

i would say this card is a family card so if you want to use it for family expenditure, this would be good”

5. Citi PremierMiles Card

| BEST FOR | Travelers |

| PAYMENT NETWORK | VISA |

| ANNUAL FEE | S$192.60 (including GST); first year is waived (if new credit card application) No annual fees for supplementary cards. |

| ELIGIBILITY | For residents: at least 21 years old with an annual income of S$30,000 or higher For foreigners: at least 21 years old with an annual income of S$40,000 or higher A Fixed Deposit Collateral of S$10,000 can be paid if you do not meet the minimum income requirement. Supplementary cardholders must be at least 18 years old. |

| WEBSITE | https://www.citibank.com.sg/gcb/credit_cards/premiermiles-visa-card.htm? |

If you’re a frequent traveler, you will definitely like the Citi PremierMiles Card. This is considered as one of the best credit cards in Singapore for travelers because it offers a handful of promos and discounts that will make spending on your travels more worth it.

Using this card also rewards you with Citi Miles, where 1 Citi Miles equates to a mile with Asia Miles, Qantas, and other airlines. Cardholders can even enjoy these airlines’ frequent flyer and hotel loyalty programs, a few of a jet-setter’s most beloved perks!

Every year, cardholders are entitled to 2 complimentary visits to airport lounges worldwide. On top of these, if you use the Citi PremierMiles card to pay for your ticket, you’re automatically covered by their travel insurance of up to S$ 1 million.

Pros

- Free travel insurance up to S$1 million

- Lots of promotions and discounts for travel and accommodations

- Citi Miles has no expiry

- Renewal bonus of 10,000 Citi miles on your card anniversary

Cons

- Lack of promotions and rewards for shopping compared to other cards

- S$25 fee for conversion and/or transfer of miles

Charges and Fees

| Interest on purchases (where applicable) | 26.90% per annum compounded if payment of the balance is not paid in full 29.99% per annum if the account is past due in the current month |

| Interest-free period | 25 days |

| Interest on cash advances | 26.90% per annum and cash interest rate |

| Minimum monthly payment | 1% of current balance + 1% of any outstanding unbilled installment amounts + interest charges + late payment charge OR S$50, whichever is higher, + overdue amounts |

| Late payment charges | S$100 if the minimum monthly payment is not paid by the due date |

| Cash advance fees | S$15 or 6% of the amount drawn, whichever is higher |

| Fees for foreign currency transactions | 3.25% |

| Overlimit fee | S$40 |

| Retrieval fee for documents | S$0 – 100 for Statement of Account; S$5 – 10 for record of charge Depends on the age of the statements being retrieved |

| Branch Service Fee | S$10.70 |

Customer Reviews

The Citi PremierMiles Card is considered as one of the best credit cards in Singapore, especially for travelers, because of its generous travel perks.

Here’s what Randy C. thinks of the Citi PremierMiles Card:

“Miles never expires. They have an attainable ~$150 cashback sign up bonus when you spend $1200 on your card in 30 days (you’ll need to apply for the Cashback and Ready Credit Card as well to enjoy this promotion). Very efficient when it comes to fraud cases. They have an express 24/7 hotline to attend to fraud cases. First block your card via the app, next call the hotline to hold the transaction and report fraudulent. Your card will be cancelled within 5 mins and you’ll receive a new card in roughly 3 working days. They also have an extremely user-friendly and secured mobile app which helps you track your bills, card spent and miles earned/rewards at ease.”

Daniel, a frequent traveler, shares his experience:

“They also have an extremely user-friendly and secured mobile app which helps you track your bills, card spent and miles earned/rewards at ease.”

Important Tips for Credit Card Holders

By now, we know that owning a credit card comes with a lot of perks and privileges. But you should also know that it also comes with rules and responsibilities.

Every year, thousands of people fall victim to various credit card-related scams and crimes. If you want to avoid falling prey to such illegal activities, check out these tips:

Look over your credit card transactions frequently.

Do this at least once or twice a week. Take note of every single purchase made with your card and make sure that you recognize each one.

Even if you don’t recognize a small charge on your statement, it’s best to contact your credit card issuer about it. You might be saving yourself a headache from a potentially bigger loss.

Pay your dues in full every month.

Instead of paying only the minimum payment every month, it’s always better to pay in full. Paying the minimum payment only will slowly generate interest and will cost you more in the long run.

By paying in full and on time, you get a better credit score and potentially even a higher credit limit. A win-win situation for everyone.

Always use a secured device and network for transactions.

When making online purchases, make sure that you’re connected to a private, secured network. Also, avoid using shared devices when making transactions.

Using shared devices and public networks (like someone’s hotspot or public Wi-Fi) will leave your information vulnerable to any hackers or suspicious individuals.

Inform your bank when you travel abroad.

Because of various credit card-related scams, banks will immediately notice any transactions made with your card if they originate from a different country. In response, they will immediately close your card and mark it for suspicious activity.

If you’re a frequent traveler, always make sure to inform your bank before you travel overseas. You wouldn’t want to be stranded without a credit card in a foreign country, now would you?

Bring cash.

Credit cards are fine and dandy, but sometimes you have to rely on cash in certain emergency situations.

If you’re going to far-off rural areas where credit cards aren’t that popular or safe to use, cash is the way to go. For the times when your credit card is declined for some reason and you can’t fix it immediately, good ol’ cash can save you from a sticky situation.

Frequently Asked Questions

How much do I need to earn to get a credit card?Although different credit cards have different requirements, most credit cards require a minimum annual income of S$30,000 or higher.

On the other hand, most credit cards require foreigners to have a higher minimum annual income of S$40,000 or higher.

Most credit card banks offer online credit card applications. However, you may need to submit some required documents to fulfill your application.

To know more information about the application process for a credit card, visit the respective bank’s official website.

Yes, most businesses and transportation services in Singapore accept credit cards. The most widely accepted credit cards in Singapore are Visa, MasterCard, and American Express.

What is the max credit limit?Your credit card’s credit limit largely depends on your annual income, but also on factors such as your age and credit score. The regulatory institution that oversees this is the Monetary Authority of Singapore (MAS).

According to MAS regulations, for most Singaporeans, the max credit limit is usually up to x4 of your monthly income.

However, those who have an annual income of at least S$120,000 (or net personal assets of at least S$2 million, or net financial assets of at least S$1 million) are entitled to no regulatory credit card limits.

Yes, you can. However, you will need to provide the issuing bank with proof that you are financially-capable of paying off credit card dues.

At what age can you get a credit card in Singapore?For most banks, you must be at least 21 years old to be a principal cardholder.

I’m below 18 years old. Can I get a credit card?Yes, you can. However, you are limited to student credit cards or prepaid credit cards.

You may also opt to be a supplementary cardholder, which is linked to a principal cardholder’s account.

Quick Suggestions for the Best Credit Cards in Singapore

The credit cards in our list above are the best credit cards in Singapore overall. But what if your needs are a bit more specific, e.g. you want a card just for shopping?

If you want some more suggestions for the best credit cards in Singapore for various purposes, this section will take care of that. We’ve run up lists of the top credit cards for certain activities too, so check them out!

Best Credit Cards for Shopping in Singapore

If you’re a shopaholic and would like to take advantage of various promos and rewards, then these credit cards would be perfect for you:

- Standard Chartered Unlimited Cashback Card

- Citi Cash Back Card

- HSBC Visa Platinum Credit Card

- Maybank Family & Friends Credit Card

- American Express True Cashback Card

To know more on how to maximize your spending with these cards, you may want to read our picks for The 5 Best Cashback Credit Cards in Singapore!

Best Credit Cards for Petrol in Singapore

If you find yourself spending a lot of money on petrol every month, you can reap rewards by getting these credit cards:

- DBS Esso Card

- UOB One Card

- Citi Cash Back Card

- OCBC Credit Card

- HSBC Platinum Visa Credit Card

To learn more about how you can save petrol money with these credit cards, check out our list of The 5 Best Credit Cards for Petrol in Singapore!

Best Credit Cards for the Frequent Traveler in Singapore

If you’re a globe-trotter who racks up a lot of miles, consider getting the following credit cards:

- American Express Singapore Airlines KrisFlyer

- Citi PremierMiles

- Standard Chartered X

- HSBC Visa Infinite

- DBS Altitude Visa Signature

To find out more about the travel privileges for each card, take a look at Our 5 Picks for the Best Miles Cards in Singapore!

And with that, we end our list of the best credit cards in Singapore worth checking out! Whether you’re a frequent buyer or a frugal spender, there’s a credit card perfect for you!

Did we miss anything in our lists? Share it with us in the comments below!

Need some quick cash for a big purchase but can’t apply for a credit card? Check out our list of the best options for personal loans in Singapore