Foreigner’s Guide for Starting a Business in Singapore

Singapore is not just a good place to buy a business but to start one as well. And it’s surprisingly uncomplicated to do so even as a nonresident.

So if you’ve been hemming and hawing about starting a business in Singapore as a foreigner, this article can hopefully help you make up your mind.

Is it easy to start a business in Singapore for foreigners?

In 2016, Singapore was hailed by the World Bank Group as the best place for doing business. This reputation has been sustained by foreign investors and businesses for over a decade, underlining what a tax haven it is.

The result is that Singapore has become a global hub for technology, trading, innovation, and foreigners seeking to do startups.

Existing SMEs have been known to either form a subsidiary company, open up a branch office, or create a representative office in Singapore.

Aside from having friendly business policies, there are also personal loans for foreigners in Singapore. The also country offers plenty of cash grants as financial support for startup companies.

So if that doesn’t convince you that it’s quite the friendly foreign business milieu here, we don’t know what will!

But before a foreigner can start a business here, some requirements first need to be met. Let’s take a closer look at them.

What are the eligibility requirements to start a business in Singapore?

There are strict eligibility requirements for setting up a business in Singapore. They include

- A work pass or visa – An Entrepreneur Pass or Employment Pass is needed if the foreign applicant intends to relocate to Singapore (more on this in a bit).

- A company name – The company name registration should abide by local laws and not contain any vulgar, symbolic, or unfamiliar terms.

- A resident director – They must be a naturalised citizen or a permanent resident with a legal work pass and no criminal records.

- Shareholders – From one up to 50 non-resident or resident shareholders are allowed.

- A company or corporate secretary – They need to be a resident or naturalised citizen appointed within six months of the business incorporation.

- A paid-up capital – There’s a recommended capital of at least S$100,000 for foreigners applying for an Employment Pass.

- The company’s registered address – The company must have a physical location, not a PO Box, that can receive and acknowledge official communications and notifications.

- Taxation exemptions – This must meet the relevant years of assessments.

The Ministry of Manpower is also quite stringent with what they call the “Fair Consideration Network.” As a foreign company operating in Singapore, you’re required to be preferential in hiring locals over foreign workers and professionals.

You can refer to reputable employment agencies for new hires or search for them yourself via online job portals.

Does a foreigner need to be a Singapore resident to start a company?

A foreigner can relocate to Singapore to start a business or be employed by one. But as previously mentioned, they would need to secure an Entrepreneur Pass or an Employee Pass first.

In our post about how to get Singapore citizenship fast, we mentioned getting into the Global Investor Programme (GIP) and investing at least S$2.5 million in the country’s economy. It’s a valid (yet expensive) way to fast-track Singaporean citizenship.

However, a foreigner doesn’t need to be a Singapore resident to start a business here. They can instead appoint a local director.

The local director must be a permanent resident or a naturalised citizen with a legal work pass and no prior convictions.

Can a foreign business be a sole proprietorship, a private limited company, or a limited liability partnership?

Foreigners can register a Sole Proprietorship, a Limited Liability Partnership (LLP), or a Private Limited Company (Pte Ltd) in Singapore.

Choosing the best kind of business structure will affect taxation and even the success of the company in Singapore.

So before registering a business in Singapore, it’s vital to deliberate on the company structure first. To give you an idea of the advantages and disadvantages, please refer to the infographic below.

Your initial investment can help determine the kind of business structure you’ll eventually choose. However, it’s practical to weigh all the pros and cons before making your decision.

For instance, you can always start with a sole proprietorship and work hard enough so you can eventually convert your business into a private limited company. But doing this presents risks and cons, as stated above.

If you know someone (or a group of up to 20 people) you think is suitable to partner up with you on your company, then go ahead and register for a Pte. Ltd. company.

It will limit the risks significantly, though your combined skill sets will truly need to be complementary for the company to work. In comparison, an LLP presents the least risks because the shareholders’ personal assets are safe from liabilities.

But when it comes to credibility and reputation, a Pte. Ltd. company takes the cake. That’s why many businesses favour this particular structure in spite of heavier incorporation costs and stricter compliance codes.

Banks and financial institutions are more likely willing to fund company expansion when it’s a private limited company, as LLPs and sole proprietorships rely heavily on the credibility of their owners and members.

Can a foreigner own 100% of the equity of a Singapore company?

Yes, foreigners can own 100% of their company’s equity shares as long as they’re over 18 years old. Doing this gives them rightful ownership of the company.

Just like locals, foreigners in Singapore are regarded as legal individuals, which means they can register a Singapore company. They don’t even have to be Singapore immigrants or go through immigration processes to do this.

Appointing a Local Director

But, as previously mentioned, a foreigner still needs to appoint a local director during the company’s registration.

Please note that a foreigner will still need to be physically present in Singapore during the period of setting up a company. While here, they can decide on where to build an official business space with the help of the Economic Development Board.

Once done, they’re free to go back to their own country to run their company overseas.

They can appoint anyone (even relatives or friends) as the local director as long as they’re over 18 years old. But it’s important to choose wisely because they’ll be the ones acting in the best interest of the company and basically being its local representative.

That person can also be a holder of an entrepreneur work visa. The same conditions apply to foreigners who want to register a partnership in Singapore.

On their behalf, the authorised representative can set important roles and services like bookkeeping, accounting, and payroll services to get the company up and running.

This also means the local director’s tasks include arranging and calling for the company’s annual general meetings, filing annual returns with local authorities, and getting a local registered address for the company.

Aside from those, the local director is also expected to take care of the company’s statutory requirements and appoint company officers.

How can a foreigner get an Entrepreneur Pass?

There are certain criteria for getting an Entrepreneur Pass in Singapore, as any corporate lawyer will advise you. They include

- Meeting the criteria and qualifications for an innovator, entrepreneur, or investor as stipulated by the Ministry of Manpower (MOM);

- Starting or having applied to a venture-backed private limited company with the Accounting and Corporate Regulatory Authority (ACRA);

- And registering the company for less than half a year from the date of application.

These steps will be further explained in the section below on how to open a company in Singapore.

How much does it cost to incorporate a company in Singapore?

To register a company with ACRA, there’s a fee of S$300. Applying for a company name will cost S$15, and it will be reserved for 60 days; otherwise, you’ll need to pay to extend this reservation.

As a foreigner or nonresident, you’ll need to assign a filing agent to register your company in Singapore. You can’t register your company on your own.

You’ll know your company’s incorporation status in Singapore once you receive an Incorporation email from ACRA. It comes with the incorporation certificate as well.

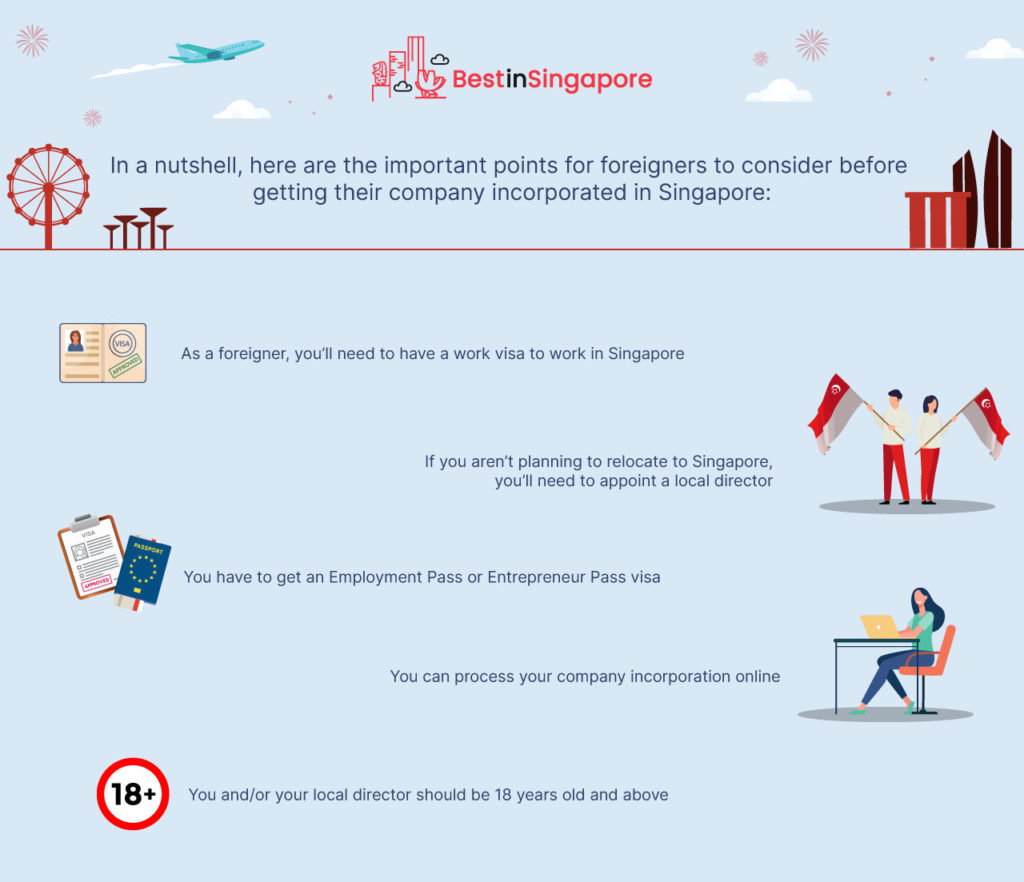

In a nutshell, here are the important points for foreigners to consider before getting their company incorporated in Singapore:

- As a foreigner, you’ll need to have a work visa to work in Singapore.

- If you aren’t planning to relocate to Singapore, you’ll need to appoint a local director.

- You have to get an Employment Pass or Entrepreneur Pass visa.

- You can process your company incorporation online.

- You and/or your local director should be 18 years old and above.

How long does it take to register a company in Singapore?

You might be surprised to find that it doesn’t take too long at all! In fact, it takes less than a week to register a business in Singapore, provided all important documents for incorporation are duly prepared.

Of course, this is the best-case scenario for foreign-owned businesses. But it does take as little as three days to register the business and then get it fully incorporated within 24 hours.

And as long as you abide by the rules of the IRAS, ACRA, MOM, and other Singapore regulatory authorities, you can look forward to having a fruitful business setup in the country.

How to Open a Company in Singapore: A Step-By-Step Guide

There are three important preliminary steps to opening a company in Singapore. We’ll be expounding on them in the sections below.

However, we believe that the steps that come after business registration are also vital.

That’s why we included some post-registration guidelines to complete the process—including the seemingly small things that can add credibility to your business.

1. Register your company name and get approval from the ACRA

The ACRA is responsible for approving new company names. It’s the first step to registering your company in Singapore, and it’s easy enough to do.

This link will take you to the Business Filing Portal home page of ACRA so you can register your company online. But please note that you can’t just register any name and expect it to be approved straightaway.

The ACRA will likely not approve company names that infringe on any existing trademark or copyright. Neither will it clear those that are obscene, vulgar, difficult to read, nonsensical, or too commonly used.

If you choose a company name that has the words media, finance, bank, or similar words in it, ACRA might direct you to higher authorities for it to be approved.

Afterwards, the company name you chose and gotten approved will be reserved for 60 days upon application. Within this period, you’re expected to incorporate your company.

2. Get all pertinent documents ready to set up your company in Singapore

After registering your company name with the ACRA, you’ll need the document for it along with other important ones to properly set up your company in Singapore. You’ll also be required to describe your business activities in succinct terms

Prepare a document that provides details of your registered company address. You’re expected to share a list of shareholders, directors, and company secretaries along with all their particulars.

If you’re a foreign business owner, you’ll need to submit a copy of your passport and proof of your overseas residential address. And if you have a foreign company, you’re also required to present a Memorandum & Articles of Associations.

3. Submit your application to ACRA

ACRA will approve your company name in the first step, but you’ll need to go back to apply for your company registration this time around.

You can do it by going to the ACRA Business Filing Portal home page mentioned a few paragraphs up.

This step is pretty uncomplicated, provided you have all the necessary documents prepared and in order.

4. Wait for the certification of incorporation

To get your official “certificate” of your business incorporation in Singapore, you’ll need a soft copy from ACRA. You’ll be receiving this by email to confirm successful incorporation.

You can request a hard copy by requesting one online as well. But this comes at a nominal cost.

Along with the certificate is your company’s registration number. Don’t lose this, as it’s an integral part of your business.

5. Request for a company business profile

To make your company known to the public (for advertising, tax filing, shareholder, or employee searches and other purposes), you’ll need a company business profile. You can also request this via the ACRA link.

Your company business profile will be required if you want to open a corporate credit card or bank account or if you need to sign a lease for office spaces.

It will cost a small fee, but you’ll have complete details about your company in PDF format. The business profile includes

- Your company registration date

- Your company registration name and number

- The previous names your company went by (if applicable)

- Your key business activities

- How much capital you paid

- Your company’s registered address

- All the particulars of your directors, shareholders, or company secretaries

6. File for business licenses and permits (according to the nature of your business)

Depending on the nature of your business, you’ll be needing to acquire and display your business license before opening up shop.

For instance, you’ll need a business license/permit if your company falls under educational institutes, finance-related services, cleaning service providers, import/export, travel agencies, and other similar industries.

You’ll be expected to have a business license if you decide to put up a restaurant as well. All food retailers in Singapore are required to apply for a Food Shop License before they can legally begin to operate.

7. Register for goods and service taxes

The Goods and Service Taxes (GST) are otherwise known as Value Added Taxes (VAT) in other countries.

In Singapore, a company with an expected S$1 million or more in annual turnovers is required to register for GST. Companies with smaller turnovers need not apply for this.

The 7% GST collected from customers will be solely your responsibility as the company owner. Please note that exported goods and services cannot be charged with GST.

To register for GST, you’ll need to file either an actual or online application at the Inland Revenue Authority of Singapore (IRAS). Submit your applications via mail or by clicking on the myTax portal at the IRAS website.

The requirements for GST registration include

- Your company’s name and registration number

- Your financial or fiscal year-end

- Your detailed business activities

- The size of your company

- Your issued capital

- Your paid-up capital

Then wait for the confirmation letter from IRAS that will include your GST registration number and date of registration.

8. Have a company stamp made

To make all company documents authentic and legal, have a company rubber stamp made. Though it’s not obligatory, it’s still widely practised in Singapore.

A legitimate company rubber stamp should bear the company name and registration number. Other things like logos and mottos are optional, but have your registration number engraved clearly.

Of course, it’s not the only proof of authenticity required, but the stamp represents your business’ professionalism and credibility. It also helps to validate official company documents, deeds, and contracts.

It will be your company secretary’s job to issue certificates to every one of your company’s shareholders.

Doing this will give your shareholders an idea of shareholding distributions and give them proof of ownership of the company. This can be done quietly or with a ceremony if you want to make it more official.

Once your company is officially registered in Singapore, it’s time to have your first board meeting with all the shareholders involved.

Official discussions should involve passing a board resolution on who the company’s director will be.

It’s also the best time to discuss other officers and positions that need to be filled within the company right away. Please note that if you don’t have a company secretary yet, it’s important to appoint one within six months of your corporation date.

Agree on how to stay compliant with Singapore laws on accounting, corporate tax filing, determination of financial year, and other filing requirements during this meeting as well.